Profiting From Politics

September 20, 2022

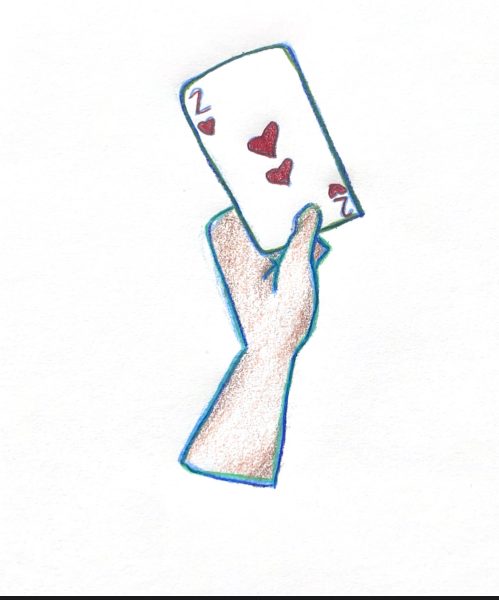

In March of 2020, Sen. Kelly Loeffler (R-GA) reportedly dumped between $1,275,000 and $3,100,000 of stocks in industries predicted to be severely impacted by the Coronavirus pandemic, and also purchased stock valued between $100,000 and $250,000 in CITRIX, a firm involved in producing software for companies with telecommuting employees. She and other members of a confidential senate briefing on the early effects of the COVID-19 pandemic, made many questionable trades that appeared to be motivated by the information they were made privy to. While this was shocking to a large majority of the American public, this is not a relatively new or isolated issue within the halls of our government.

An inquiry conducted by the New York Times into congressional stock trades found that “97 lawmakers or their family members bought or sold financial assets over a three-year span in industries that could be affected by their legislative committee work.” Despite the Stop Trades based On Congressional Knowledge (STOCK) Act being passed in 2012 under the Obama Administration, the penalties are small for violations, with the standard fine being $200. This creates an environment within our legislature where lawmakers feel as though they have the ability to trade based on information often unknown to the public, with little to no oversight or accountability.

Many attempts have been made in both the U.S. House of Representatives and the U.S. Senate to draft new legislation to regulate the trades by congresspeople, but almost all have failed, despite having widespread bi-partisan support. This is due, in part, to many congressional leaders and heavyweights throwing their support against these initiatives. Most notable of these dissenters is the Speaker of the House, Nancy Pelosi (D-CA), who has come on record multiple times against regulation or a ban on stock trading for congressional members, including against the STOCK Act of 2012. According to a report compiled in 2014 by Ballotpedia, it is worth noting that Nancy Pelosi has increased her net worth by approximately $37,000,000 since her election in 1968. The annual salary for the Speaker of the House, according to the U.S. House of Representatives Press Gallery Website, is $223,500. Seeing these congressional leaders come out against self-regulation of insider trading while also accruing massive amounts of wealth is disheartening to many, and has had a severe effect on the downwards trend of public confidence in the government.

The notion that lawmakers can make decisions on their financial assets based on confidential or unpublicized knowledge, or vice versa, make decisions on laws and policy based on their financial holdings, is not only unethical but incredibly corrupt. In many cases, this ability adds a profit motive to the votes and legislation produced by representatives and repeatedly incentivizes congresspeople to act based on what will make them the most money, and not based on the will or wellbeing of their constituents. Why should our elected representatives be able to make decisions based on money and not the will of their constituents, who are subjected to even harsher insider trading and economic collusion laws and penalties? In a period where public trust in the government is at an all-time low, lawmakers making these insider trades in the view of the public eye only serves to sow more division and distrust between the government and the governed.

Congressional lawmakers participating in the stock market is a conflict of interest and a clearly unethical practice. The notion that legislation for regulation has not yet been passed is not only a failure of the governing system, but it is a failure of the duty that our elected representatives have to the people they represent. The financial incentive generated by these trades has turned the government into a body plagued by personal interest and profit-chasing. A government cannot function without the support and trust of its constituents, and no one can consciously support a government that serves only to advance its personal financial interests.

Sam • Sep 24, 2022 at 12:24 pm

Great topic and great writing!